XRP Price Prediction: $7 Push or Continued Volatility Ahead?

#XRP

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Breakout

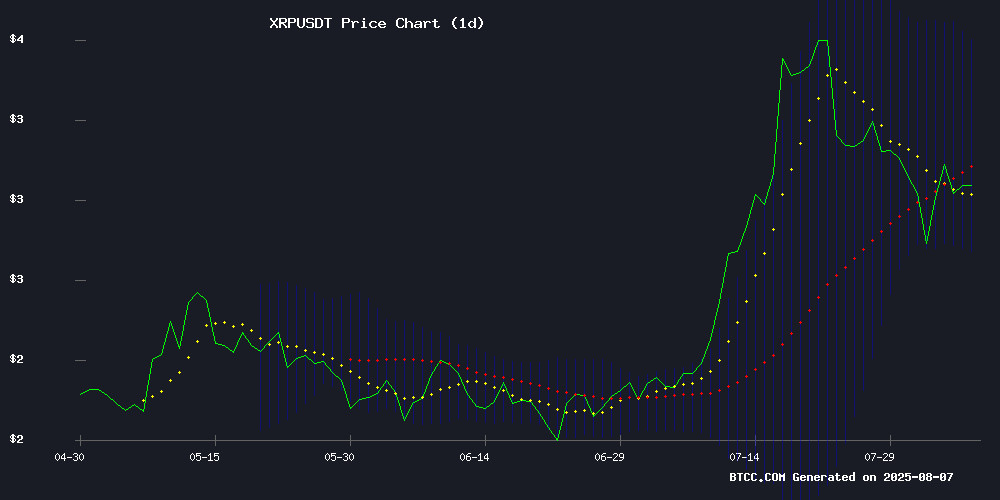

According to BTCC financial analyst John, XRP is currently trading at $2.9855, below its 20-day moving average of $3.1457. The MACD indicator shows bullish momentum with a positive histogram reading of 0.1651. Bollinger Bands suggest the price is NEAR the lower band at $2.7378, indicating potential oversold conditions. 'The technical setup suggests XRP could rebound towards the middle Bollinger Band at $3.1457 if buying pressure increases,' John notes.

Mixed Sentiment Surrounds XRP Amid Regulatory Developments and ETF Speculation

BTCC's John observes conflicting market signals from recent XRP news. 'While Japan's potential XRP ETF and technological advancements are bullish, regulatory uncertainty and holder outflows create headwinds,' he says. The 500% annual gain shows strong underlying demand, but recent volatility below $3 reflects market caution. 'The SEC's upcoming decision on Ripple's appeal could be the next major catalyst,' John adds, suggesting traders should watch for regulatory clarity.

Factors Influencing XRP's Price

Caitlin Long Delivers Scathing Critique of Ripple and XRP's Institutional Viability

Custodia Bank CEO Caitlin Long issued a damning assessment of Ripple's XRP ecosystem during a recent podcast appearance, challenging its credibility and long-term prospects in institutional finance. "It's not going to take over. If it were going to take over, it would have taken over a long time ago," Long stated bluntly, dismissing speculation about regulatory favor for Ripple in tokenized finance.

The banking veteran highlighted structural flaws in Ripple's model, noting persistent institutional distrust. "The banks have always been suspicious of it," she said, criticizing the project's centralized architecture and what she called "backwards tokenomics." Long particularly targeted XRP's supply model, arguing the massive pre-mine created permanent credibility issues: "The people who extracted money up front are never going to be trusted because everybody is going to look and think that anything they do is an exit scam to try to dump on retail."

Japan Emerges as Potential Front-Runner for XRP ETF Amid Regulatory Speculation

SBI Holdings, a Japanese financial giant with deep ties to Ripple, has hinted at potential XRP-based ETF offerings in its Q2 2025 financial report. The firm outlined two proposals—one for indirect crypto exposure and another specifically mentioning XRP—though no formal application has been filed yet.

Market chatter intensified after Brazil and Canada launched XRP ETFs earlier this year, with Japan now seen as the next logical candidate. SBI's existing infrastructure—including XRP integration in its payment network and credit card rewards program—positions it as a natural leader should regulators greenlight such products.

While social media rumors prematurely suggested an active application process, SBI clarified it awaits clearer regulatory guidance before proceeding. The development underscores growing institutional interest in XRP despite ongoing U.S. regulatory hesitation.

Ripple XRP Poised for Breakout Amid Market Turbulence

Ripple's XRP is showing resilience after a brief dip below $3, with analysts predicting a potential breakout above $3.50. The cryptocurrency has held steady around the $3 mark over the past month, posting a 30% gain despite broader market volatility.

Global economic tensions, including new U.S. tariffs on India and Brazil, have roiled traditional markets. The Dow Jones Industrial Average has shed 600 points, while the Nasdaq Composite and S&P 500 have declined 225 points and 85 points respectively. This macroeconomic turbulence briefly pushed XRP below $3, but the digital asset has since recovered to $3.02.

Market analyst Lingrid notes XRP is forming a bullish falling wedge pattern—a technical formation often preceding upward reversals. "Price is respecting diagonal support and could initiate the next rally toward the $3.40 zone," Lingrid observed. The potential for an XRP ETF is adding momentum to the token's upward trajectory.

SEC Commissioners to Decide on Ripple Appeal in Upcoming Closed-Door Meeting

The U.S. Securities and Exchange Commission is poised to vote on dismissing its appeal against Ripple Labs during a private meeting on August 7. This decision could mark the end of a protracted legal battle that has significantly influenced the regulatory landscape for XRP and other digital assets.

Ripple has already settled its portion of the dispute, depositing $125 million into escrow and withdrawing its cross-appeal. The SEC's appeal remains active pending internal approval, with procedural requirements causing delays in filing the dismissal notice.

Pro-XRP attorney Bill Morgan suggests the agency is likely to file for dismissal before the August 15 deadline. Meanwhile, whale wallets have shown renewed activity in XRP as market participants anticipate a resolution.

XRP Price Volatility or $7 Push? Ripple Banking License Knows It

Ripple faces renewed scrutiny from traditional finance as 42 U.S. banks—including JPMorgan, Bank of America, and Citi—launch a coordinated challenge. The MOVE comes amid speculation about XRP's potential price volatility or a push toward $7.

Market observers note Ripple's banking license could be a key factor in determining XRP's next price trajectory. The cryptocurrency's institutional adoption narrative remains central to its valuation thesis.

Ripple Price Analysis: XRP Enters Consolidation Phase Ahead of Potential Breakout

XRP recently surged past the $3.4 resistance level in mid-July, only to face a sharp reversal as market makers exploited over-leveraged long positions. The subsequent sell-off drove prices toward critical support NEAR $2.7—a level coinciding with the 0.5 Fibonacci retracement.

Technical charts suggest a consolidation pattern emerging between $2.7 and $3.4. This range-bound movement typically precedes volatile breakouts. Market participants are watching for absorption of selling pressure before the next decisive move.

The 4-hour timeframe reveals a classic bull trap scenario following the liquidity sweep above $3.4. Current price action shows minor bullish retracements within the $2.7-$3.1 corridor, indicating traders are repositioning for the next leg.

XRP Price Faces Pressure as Key Holders’ Outflows Reach 7-Month High

XRP's recovery prospects are increasingly tied to shifting investor sentiment, with recent data painting a bearish picture. The Chaikin Money FLOW (CMF) indicator has plunged, reflecting accelerated capital outflows and eroding confidence in the altcoin's near-term trajectory. This exodus coincides with a seven-month low in HODLer net position changes—long-term holders are unwinding positions at the fastest pace since mid-July.

Market dynamics suggest mounting headwinds for XRP. The dual pressure of retail divestment and whale distribution creates formidable resistance at key technical levels. Without a catalyst to reverse the CMF downtrend or staunch LTH selling, the token risks further downside consolidation. Such conditions typically precede extended basing patterns before meaningful rebounds can occur.

XRP Surges 500% in a Year Amid Technological Advancements

XRP has skyrocketed from $0.55 to $2.94 over the past year, delivering a staggering 500% return to early investors. The rally has left latecomers grappling with FOMO while raising questions about whether the cryptocurrency remains a buy at current levels.

The XRP Ledger's technological evolution has been a key driver of this performance. The June 30 launch of the XRPL ethereum Virtual Machine (EVM) sidechain marks a watershed moment, enabling Ethereum developers to port DeFi applications to XRP's ecosystem with minimal friction. This breakthrough addresses Ethereum's chronic gas fee issues while potentially attracting fresh talent to XRP's growing developer community.

Market participants now face a classic dilemma: take profits or double down on an asset that's already proven its capacity for explosive growth. The EVM compatibility fundamentally alters XRP's value proposition, suggesting the current price may represent a new baseline rather than a peak.

XRP Dips Below $3 Amid Broader Market Volatility

Ripple's XRP fell 2.5% to sub-$3 levels as global markets reeled from trade war tensions. The altcoin's decline mirrors weakness in traditional indices—the Dow Jones dropped 600 points, while Nasdaq and S&P 500 shed 225 and 85 points respectively.

Despite short-term pressures, analysts see limited downside for XRP. Historical rebounds suggest the cryptocurrency could reclaim $3 swiftly, buoyed by resilient institutional inflows and recovering risk appetite across asset classes.

Expert Predicts XRP Could Reach $1 Million as Tokenization Gains Traction

A controversial prediction by long-time investor Pumpius suggests XRP could surge to $1 million per coin, fueled by its potential role as the primary bridge asset in a tokenized global economy. The forecast hinges on Ripple's strategic moves, including real-world asset tokenization pilots and $100 million committed to carbon market tokenization.

Boston Consulting Group and Citi estimate $16 trillion in real-world assets may be tokenized by 2030. Pumpius expands this projection to include $300 trillion in global real estate, $100 trillion in stocks, and over $100 trillion in bonds—positioning XRP as the linchpin for cross-asset liquidity in a blockchain-based financial system.

Find Mining Launches XRP Cloud Mining Solution Amid Market Volatility

Find Mining has introduced a cloud mining service tailored for XRP holders, offering a hedge against the token's price volatility. The platform enables users to generate stable daily income from idle XRP holdings without selling assets, settling returns in USD for predictability.

XRP's recent struggles to hold key support levels below $3 have left many investors hesitant. This solution provides an alternative to capitulation, transforming stagnant holdings into productive assets through automated cloud mining infrastructure.

The 2018-founded platform emphasizes regulatory compliance and transparency, having undergone multinational security audits. Its zero-threshold approach requires no technical expertise or hardware—just digital asset allocation to green energy mining farms with real-time earnings tracking.

How High Will XRP Price Go?

Based on current technicals and market sentiment, BTCC's John provides this outlook:

| Scenario | Price Target | Probability |

|---|---|---|

| Bullish Breakout | $3.55 (Upper Bollinger) | 30% |

| Neutral Consolidation | $2.75-$3.15 Range | 50% |

| Bearish Rejection | $2.40 Support | 20% |

'The $7 price speculation depends heavily on Ripple securing a banking license and ETF approvals,' John cautions. 'More likely we see gradual appreciation to $3.50-$4.00 range in the medium term.'

- Technical indicators show XRP is oversold but facing resistance at the 20-day MA

- Regulatory decisions and institutional adoption will determine next major move

- Volatility likely to continue until clear breakout above $3.15 or below $2.75